Buying a home is a good step and can be a huge financial commitment. It is a big responsibility. For first-time home buyers, it can sometimes be challenging.

A guide is mostly needed and these tips can serve as a guide for first-time home buyers:

- BUDGET:

Having a budget plan is very important for first-time home buyers. This will enable you to focus on properties that you can afford, areas within your budget, or houses that are under mortgage financing. First-time house buyers that are planning to buy a mortgaged house need to also consider their monthly income and expenses.

- PROPERTY TYPE:

You will need to ask yourself the following question: What kind of house can I buy with my budget? Whether it is a government or private housing scheme; flat, bungalow or duplex; detached, semi-detached or terrace; housing, garage or kitchen space; house facilities such as gym, swimming pool, football pitch or children’s play area, gated estate or lone houses and many more! Your answers should serve as a guide. You might need to have a prepared checklist.

- LOCATION:

First-time home buyers should also examine the location. For instance, those in Lagos will like to consider areas with good security, less traffic, access to their office, schools, areas with good roads, etc.

- HOUSING AGENT:

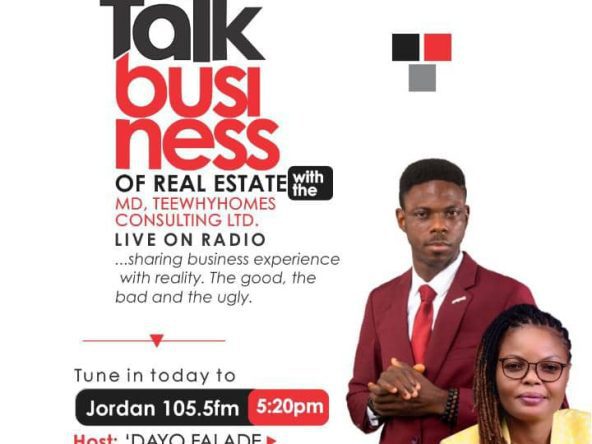

First-time home buyers should also ensure they get a good housing agent. Some people think they can do this alone, however, it is advisable to do this with a trusted agent, preferably a registered company house agent not a lone agent. Teewhyhomes Consulting Limited is a trusted and registered Real Estate company that can help to achieve your investment goals.

- PROPERTY DOCUMENTS:

First-time home buyers should also ensure the chosen property of their choice comes with the right land documents. It is crucial to educate yourself on the various types of house documents. If you found this useful, kindly reach out to us at Teewhyhomes and let us know how we may help you through the buying process.